To properly handle 1099-MISC transactions in QuickBooks, you must complete a couple of setup steps. In the Company PREFERENCES you must activate the tracking of 1099 in general. To navigate here, please select EDIT – PREFERENCE – TAX Settings in SINGLE USER mode and you will see the following:

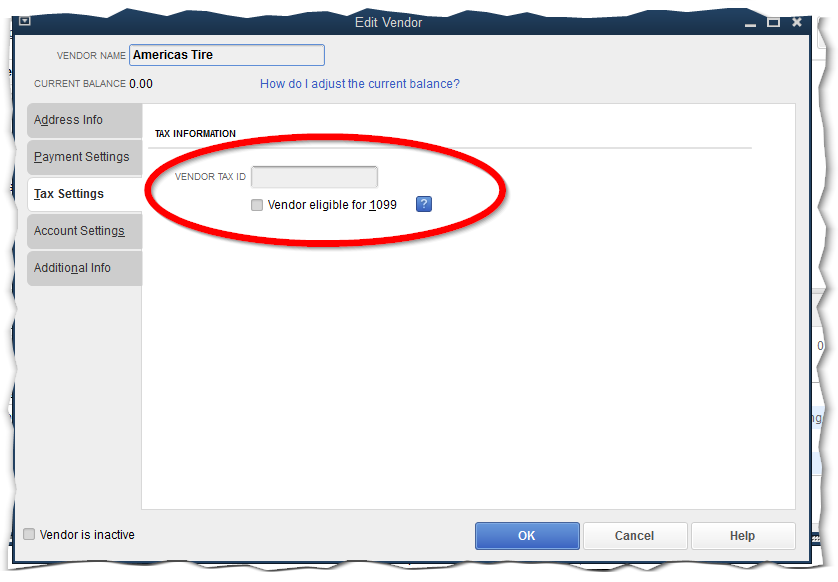

This function will activate the 1099-MISC tracking in general. Afterwards, you must also activate the individual Vendor for whom you wish to track a 1099. This is done on the regular Vendor Card. Select the Vendor Center, find the Vendor in question and double click. After the Vendor Card opens, select the TAX INFORMATION Tab to see the following:

Make sure to enter the Vendor’s TAX ID, which is typically their Social Security Number, and CHECK the box, as indicated.

In addition, QuickBooks offer a Wizard which allows you to select specific GL Accounts for which a 1099 is being calculated, while others are not part of the total. This will allow you to handle AP Bills properly with regards to amounts which are taxable and others, which are not.

For more information, or for assistance with the proper Implementation and Maintenance of your QuickBooks Solution, please call Tel. (855) 227-0700. Our Consulting team is available and more than happy to assist.

Comments